Offsite Bookkeeping Your Businesss Secret Weapon

Off-site bookkeeping is a powerful tool for businesses of all sizes. It involves outsourcing your accounting tasks to a specialized firm, freeing up valuable in-house resources and potentially boosting efficiency. This approach offers a range of advantages, from cost savings and expert guidance to improved accuracy and scalability. Different providers offer various services and pricing models, so understanding the options is crucial for making an informed decision. This guide explores the key aspects of off-site bookkeeping, from defining it to choosing the right provider, and even covers procedures, best practices, and integration with your existing systems.

Defining Offsite Bookkeeping

Off-site bookkeeping differs significantly from on-site bookkeeping. On-site bookkeeping involves an in-house bookkeeper or accounting team managing the company’s financial records. Conversely, off-site bookkeeping relies on external accounting professionals who work remotely, handling the records from a dedicated off-site location. This distinction significantly impacts the organizational structure and operational costs of the business.

Key Characteristics of Offsite Bookkeeping

Offsite bookkeeping is characterized by its remote nature and reliance on technology for communication and data transfer. Key distinctions include:

- Remote Location: Bookkeeping tasks are performed by professionals outside the business’s physical office.

- Technology Dependence: Secure online platforms and communication tools are essential for data sharing and collaboration.

- Specialized Expertise: Offsite providers often have a team with expertise in accounting software and industry-specific regulations.

- Scalability and Flexibility: Offsite bookkeeping services can adapt to fluctuating business needs, offering tailored support for varying levels of complexity and volume.

Types of Offsite Bookkeeping Services

A range of off-site bookkeeping services caters to diverse business needs. These services encompass different levels of support and customization:

- Basic Bookkeeping: This service often includes handling transactions, preparing basic financial statements, and reconciling bank accounts. It’s ideal for businesses with simple financial operations.

- Advanced Bookkeeping: This service covers all aspects of bookkeeping, including complex financial reporting, budgeting, and tax preparation. It’s suitable for businesses with sophisticated financial requirements.

- Payroll Processing: Moff-siteesite bookkeeping services include payroll management, handling employee compensation, deductions, and compliance.

- Tax Preparation: Some providers offer tax preparation services, guiding businesses through tax season and ensuring compliance with relevant regulations.

Comparison of Pros and Cons

Off-site bookkeeping presents several advantages and disadvantages:

Pros

- Cost-effectiveness: Often more affordable than hiring in-house staff, particularly for smaller businesses.

- Access to Expertise: Businesses gain access to experienced accounting professionals with specialized knowledge.

- Increased Efficiency: Streamlines financial operations, allowing business owners to focus on core competencies.

- Scalability: Offsite services can adapt to the fluctuating demands of growing businesses.

Cons

- Potential Communication Challenges: Reliance on communication channels can lead to delays or misunderstandings.

- Data Security Concerns: Safeguarding sensitive financial data is crucial when outsourcing.

- Limited Hands-on Control: Business owners have less direct control over the daily operations of their bookkeeping.

- Finding a Reputable Provider: Choosing a trustworthy and reliable provider is essential.

Bookkeeping Service Providers, Offsite bookkeeping

The table below presents a sample of bookkeeping service providers, highlighting their areas of specialization, pricing models, and customer feedback:

| Provider | Specialization | Pricing Model | Customer Reviews |

|---|---|---|---|

| Example Provider 1 | Small Businesses | Hourly/Project-based | Positive/Neutral |

| Example Provider 2 | Medium Businesses | Monthly Subscription | Positive/Mixed |

| Example Provider 3 | Non-profit Organizations | Fixed-fee/Project-based | Excellent |

Benefits of Offsite Bookkeeping

Source: offsiteoffice. Co. Off-site bookkeeping offers a multitude of advantages for businesses of all sizes. By outsourcing bookkeeping tasks, companies can free up valuable internal resources and focus on core competencies. This approach can significantly impact profitability and efficiency, while also enabling better financial planning and decision-making.

Outsourcing bookkeeping functions allows businesses to access specialized expertise and streamlined processes, often at a lower cost than maintaining an in-house accounting team. This shift in resource allocation allows businesses to scale effectively and adapt to changing market demands.

Financial Advantages

Outsourcing bookkeeping often leads to substantial cost savings. Businesses avoid the expenses associated with hiring, training, and retaining in-house bookkeepers. These savings can be significant, particularly for smaller companies with limited budgets. Additionally, the efficiency gains from outsourcing can lead to increased profitability.

Efficiency Improvements

Offsite bookkeeping significantly improves efficiency by freeing up in-house staff. Personnel previously dedicated to bookkeeping can be redirected to more strategic roles, such as product development, marketing, or sales. This reallocation of resources often results in increased productivity and improved overall business performance.

For example, a small e-commerce company might initially struggle with managing inventory tracking, sales reporting, and invoicing. Outsourcing bookkeeping can free up their staff to focus on expanding their online store, marketing campaigns, and customer service. This leads to quicker turnaround times for sales, improved customer satisfaction, and a more efficient overall business operation.

Resource Allocation and Scalability

Off-site bookkeeping plays a critical role in supporting business scalability. As a company grows, the complexity of bookkeeping tasks increases. Outsourcing allows the business to adapt to this increased complexity without the need to significantly increase its in-house staff. The scalability of off-site bookkeeping services ensures that the company can continue to operate efficiently, regardless of its size or growth trajectory.

Examples of Resource Reallocation

A medium-sized manufacturing company, for instance, can redirect personnel from data entry and reconciliation tasks to focus on improving production processes, increasing output, and optimizing inventory management. This shift in focus can lead to substantial gains in efficiency and cost savings, which directly translate into increased profitability.

Role in Scalability

Offsite bookkeeping can accommodate fluctuating workloads and scaling needs. When a company experiences a surge in sales or new projects, the bookkeeping provider can handle the increased volume without significant adjustments to the company’s internal structure. This agility allows businesses to respond quickly to market changes and opportunities, further enhancing scalability and adaptability.

Summary of Benefits by Business Size

| Business Size | Benefit 1 | Benefit 2 | Benefit 3 |

|---|---|---|---|

| Small | Cost Savings (reduced overhead) | Specialized Expertise (access to skilled professionals) | Focus on Core Business (enhanced efficiency and strategic focus) |

| Medium | Scalability (adaptability to growth) | Reduced Overhead (lower operational costs) | Improved Accuracy (minimizing errors and improving financial reporting) |

| Large | Increased Efficiency (streamlined processes and procedures) | Expert Support (access to advanced bookkeeping strategies) | Reduced Risk (mitigation of potential errors and compliance issues) |

Choosing the Right Offsite Bookkeeping Provider

Selecting a reliable off-site bookkeeping provider is crucial for the smooth operation of your financial processes. A well-chosen provider can free up valuable time and resources, ensuring accurate financial records and timely reporting. Careful consideration and a thorough evaluation process are essential to ensure the chosen provider aligns with your business needs and goals.

A critical aspeoff-siteeffsite bookkeeping is selecting a provider who understands your specific financial requirements and can tailor their services to meet your needs. This includes recognizing the nuances of your industry and any unique accounting regulations that apply. Choosing the right provider sets the stage for successful financial management and growth.

Factors to Consider When Selecting a Provider

Selecting the appropriate off-site bookkeeping provider necessitates careful evaluation of several key factors. Understanding these factors will help you make an informed decision and ensure a partnership that aligns with your business objectives. The selection process should consider the provider’s expertise, communication style, and contractual terms.

- Provider Reputation and Experience: Researching a provider’s reputation and experience is paramount. Look for providers with a proven track record of success, positive client testimonials, and a history of delivering accurate and timely financial reports. Seek references from previous clients to gauge their satisfaction with the provider’s services. The provider’s experience in your industry can be a valuable asset, demonstrating an understanding of specific accounting regulations and industry-standard practices.

- Communication and Contract Terms: Clear and consistent communication is essential. Evaluate how the provider communicates updates, addresses concerns, and handles inquiries. A provider who actively communicates and responds promptly to requests is at a significant advantage. Thoroughly review the contract terms, ensuring clarity on service offerings, pricing models, and dispute resolution procedures. Explicit clauses on data security and confidentiality should be prominent.

- Pricing Models and Service Offerings: Different pricing models exist for off-site bookkeeping services. Providers may offer a fixed monthly fee, a per-transaction fee, or a combination of both. Compare the costs associated with different service offerings to determine the most suitable option for your needs. Understand the implications of each pricing model on your overall budget and financial reporting. A detailed comparison of pricing models and service offerings is critical for informed decision-making.

Evaluation Checklist for Potential Providers

A structured checklist can streamline the evaluation process. Using a checklist allows for a comprehensive evaluation, considering various aspects of a potential provider. This systematic approach helps to ensure you make an informed choice.

- Financial Reports: Request samples of financial reports generated by the provider to assess their accuracy and comprehensiveness. Verify the formats and clarity of the reports, confirming they meet your specific requirements.

- Communication: Evaluate the provider’s communication channels and response times to assess their responsiveness and efficiency. Assess the provider’s ability to answer questions and address concerns promptly.

- Client References: Seek references from previous clients to understand their experiences and gauge the provider’s performance in handling similar financial situations.

- Contract Review: Thoroughly review the contract terms, focusing on payment schedules, service guarantees, and dispute resolution procedures. Confirm that the contract adequately addresses your business needs and concerns.

Pricing Models and Service Offerings

A table illustrating different pricing models and service offerings can aid in making a cost-effective decision. Understanding the relationship between service packages and their associated costs is crucial for aligning the bookkeeping service with your budget.

| Service | Description | Cost | Additional Fees |

|---|---|---|---|

| Basic Bookkeeping | Record Keeping, Bank Reconciliation, and Basic Reporting | $150/month | Account Reconciliation, Bank Feeds ($25/month), Payroll Integration ($50/month) |

| Advanced Bookkeeping | Financial Reporting, Budgeting, Forecasting, and Payroll Processing | $300/month | Custom Reports ($50/report), Tax Preparation ($100/return) |

Procedures and Best Practices for Offsite Bookkeeping

Offsite bookkeeping offers significant advantages for businesses, but successful implementation hinges on well-defined procedures and best practices. This section details key steps and considerations for streamlined and secure off-site bookkeeping processes.

Effective off-site bookkeeping requires a structured approach that prioritizes clear communication, secure data handling, and regular reporting. By establishing robust procedures and adhering to best practices, businesses can ensure accuracy, efficiency, and compliance.

Step-by-Step Procedures for Effective Offsite Bookkeeping

A structured approach to off-site bookkeeping streamlines processes and ensures accuracy. Initiate by clearly defining responsibilities and establishing communication protocols between the business and the off-site bookkeeping provider. This includes agreed-upon timelines for data submission and reporting. Subsequently, regularly review financial statements and reconcile accounts to maintain accuracy. This proactive approach prevents discrepancies and facilitates timely issue resolution. Regularly scheduled meetings with the provider are beneficial to address concerns and keep the bookkeeping process on track.

Secure Data Transmission and Storage

Secure data transmission and storage are paramount in off-site bookkeeping. Robust security measures protect sensitive financial information from unauthorized access and breaches. This includes the implementation of encryption protocols for data transmission and secure storage solutions for the off-site provider. Furthermore, regular security audits and updates for the provider’s system should be mandatory.

Regular Communication and Reporting

Regular communication and reporting are essential for maintaining transparency and accountability. Establish clear communication channels, including email, phone, and online platforms, to ensure prompt and efficient information exchange. Regular reporting, such as monthly financial statements, allows for the timely identification and resolution of issues. Implementing a system for tracking and documenting communication ensures a complete record of interactions.

Best Practices for Managing Financial Records

Thorough record-keeping is critical for accurate bookkeeping. Establish clear procedures for documenting all financial transactions. This includes detailed descriptions, dates, and amounts for every entry. Utilize standardized formats for invoices, receipts, and other financial documents to maintain consistency. Employing cloud-based systems can facilitate secure and centralized access to records.

Frequently Asked Questions about Offsite Bookkeeping

- What are the typical costs associated with off-site bookkeeping? Costs vary depending on the provider, the volume of transactions, and the complexity of the bookkeeping services required. A comprehensive cost breakdown from the provider should be obtained before any agreement is made.

- How can I ensure the confidentiality of my financial data? The provider should have demonstrable security protocols in place, including data encryption and secure storage solutions. Verify that they adhere to industry standards and regulations.

- What level of support can I expect from the off-site keeping provider? Seek details about the provider’s support team, including response times and available contact methods. A robust support system ensures prompt assistance when needed.

Key Considerations for Data Security

Data security is paramount in off-site bookkeeping. Understanding and implementing appropriate measures for protecting financial information is critical. These measures include access controls, secure data transmission methods, and regular security audits.

- Data encryption: Encrypting data both in transit and at rest safeguards sensitive information from unauthorized access.

- Secure file sharing: Employ secure file-sharing platforms for transferring data between the business and the provider.

- Multi-factor authentication: Implement multi-factor authentication to enhance access control and prevent unauthorized login attempts.

- Regular security audits: Conducting regular security audits assesses the effectiveness of existing security measures and identifies potential vulnerabilities.

Examples of Data Security Protocols

Robust data security protocols are crucial for safeguarding financial informationSfiFile-sharing platforms, such as those utilizing encryption protocols, are essential for transmitting data. Data encryption protocols protect sensitive information both during transmission and storage. Multi-factor authentication adds an extra layer of security by requiring multiple forms of verification for logins.

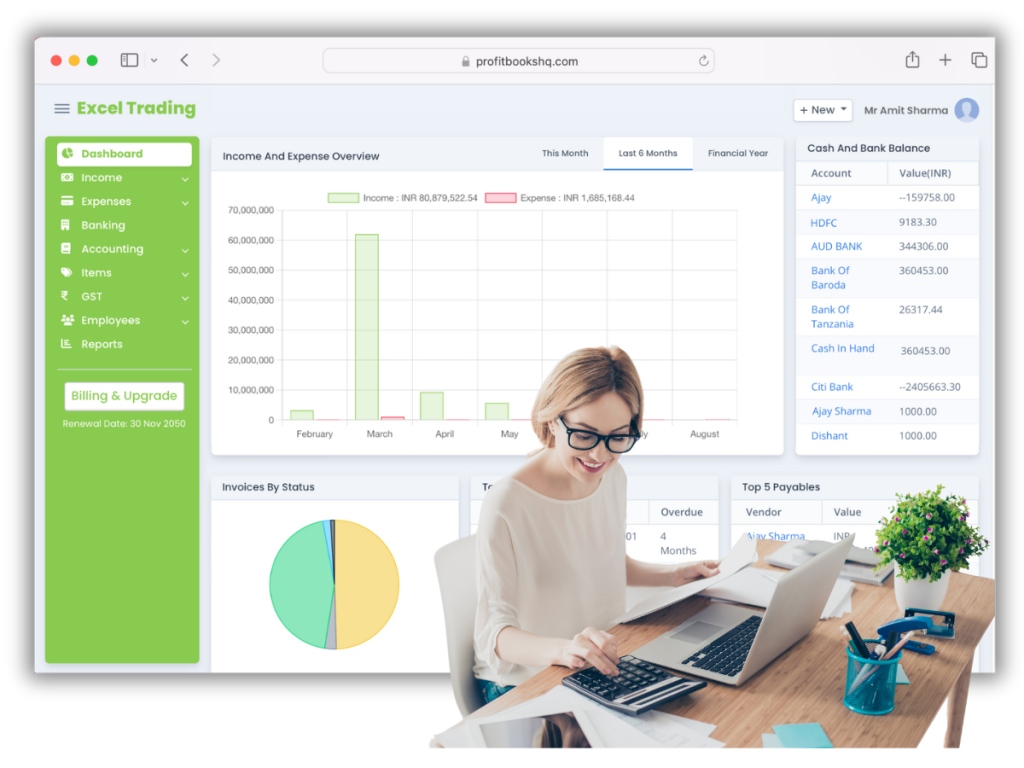

Integrating Offsite Bookkeeping with Other Systems

Offsite bookkeeping providers are increasingly integrating their services with various accounting and business management software. This integration streamlines workflows, improves data accuracy, and enhances overall efficiency for businesses of all sizes. By connecting with existing systems, off-site bookkeepers can leverage automation and real-time data access, reducing manual effort and minimizing errors.

Integration with Accounting Software

Off-site bookkeeping services often integrate with popular accounting software platforms. This integration facilitates a seamless flow of financial data between the software and the bookkeeping provider’s system. The most common accounting software integration utilizes Application Programming Interfaces (APIs). APIs act as digital intermediaries, enabling the exchange of data in a structured format. This automated data transfer eliminates the need for manual data entry, significantly reducing the risk of errors.

Role of APIs in Data Transfer

APIs play a crucial role in facilitating seamless data transfer between on-site and off-site systems and other applications. These interfaces allow for real-time data synchronization, ensuring that financial records are consistently updated across all connected platforms. Using APIs, off-site bookkeepers can access, modify, and report on financial data directly within the client’s accounting software. This direct access often improves accuracy and reduces the possibility of human error.

Integrating with CRM and ERP Systems

Integrating off-site bookkeeping with Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems can provide a comprehensive view of the business. By connecting financial data with customer interactions and operational data, businesses gain a holistic understanding of their performance. This integration allows for more informed decision-making, particularly in areas like sales forecasting and resource allocation. For example, tracking sales revenue from a CRM system and matching it with corresponding expenses from the bookkeeping system helps in generating accurate profit and loss statements.

Examples of Successful Integrations

Many businesses have successfully integrated off-site bookkeeping with their existing accounting and business management software. A common example involves integrating Xero with an off-site bookkeeping provider. This integration allows the bookkeeping provider to access and update financial data within Xero in real-time, automating tasks such as invoice processing and bank reconciliation. Similarly, QuickBooks users can leverage integrations to streamline financial reporting and improve operational efficiency. The ability to automatically update financial records in the client’s chosen accounting software is key to successful integration.

Data Accuracy and Consistency

Data accuracy and consistency are paramount when integrating off-site bookkeeping with other systems. Errors in data transfer can lead to inaccurate financial reports, potentially impacting business decisions. Robust integration processes, combined with stringent data validation procedures, minimize these risks. A critical step is implementing data validation checks to ensure that the data being transferred conforms to established standards and formats. Consistent data formats across all integrated systems are vital to ensure accurate reporting.

Software Integration Table

| Software | Integration Type | Benefits |

|---|---|---|

| Xero | API | Seamless Data Transfer, Real-time Updates, Improved Reporting |

| QuickBooks | API | Improved Automation, Reduced Manual Effort, Enhanced Data Accuracy |

| Sage | API | Streamlined Financial Reporting, Data Consistency, and Improved Operational Efficiency |

Final Conclusion

In conclusion, off-site bookkeeping presents a compelling opportunity for businesses to optimize their financial operations. By outsourcing bookkeeping tasks, companies can access specialized expertise, reduce overhead, and improve accuracy. Selecting the right provider is paramount, and careful consideration of factors like reputation, experience, and clear communication is essential. This process ultimately leads to greater efficiency, scalability, and a focus on core business functions. Understanding the procedures, best practices, and integrations with existing systems is crucial for a smooth transition and successful implementation.